When planning for the future, our Louisiana estate planning lawyer can help you clarify your wishes and legally enforce them with the documents that best suit your interests. Upon creating an estate plan, many people experience immense relief that their assets and goals have been accounted for. However, please keep in mind that you should regularly update your plan over time to reflect any major life changes, as your wishes will certainly evolve as you and your family do.

Our attorneys at Theus Law Offices are ready to listen to your story and develop a customized estate plan that leaves nothing out. Call us today to schedule a consultation with our experienced and strategic firm.

It's never too early to start thinking about estate planning. In fact, the earlier you start, the better prepared you will be in case of unexpected events such as incapacity or premature death. Regardless of age, income level, or family situation, everyone can benefit from having an estate plan in place. If you have children or other dependents, it is especially important to have an estate plan. In the event of your unexpected death or incapacity, an estate plan can ensure that your loved ones are taken care of.

Table Of Contents

- Choosing Beneficiaries

- Factors To Consider In Your Estate Plan

- Louisiana Estate Planning Infographic

- Statistics

- Estate Planning FAQs

- Theus Law Offices

- Contact Our Firm Today

The Estate Planning Process

Developing an estate plan involves deciding how assets will be distributed. In addition to plans for the distribution of assets to beneficiaries, plans are also made regarding who will manage these assets. These plans stem beyond just asset planning and management; estate planning also involves the process of determining critical aspects of a person’s life, such as who will care for their children and how they will be financially cared for. It’s important to note that an estate plan is far more extensive than a will. It also incorporates procedures for when a person is incapacitated or unable to make decisions independently.

If you own any assets, such as a home, retirement accounts, art collection, or investments, having an estate plan can help ensure that those assets are distributed according to your wishes. Without a plan in place, your assets may be subject to probate, which can be a lengthy and expensive process. An estate plan can also help minimize taxes and administrative costs, ensuring that more of your assets are passed on to your beneficiaries.

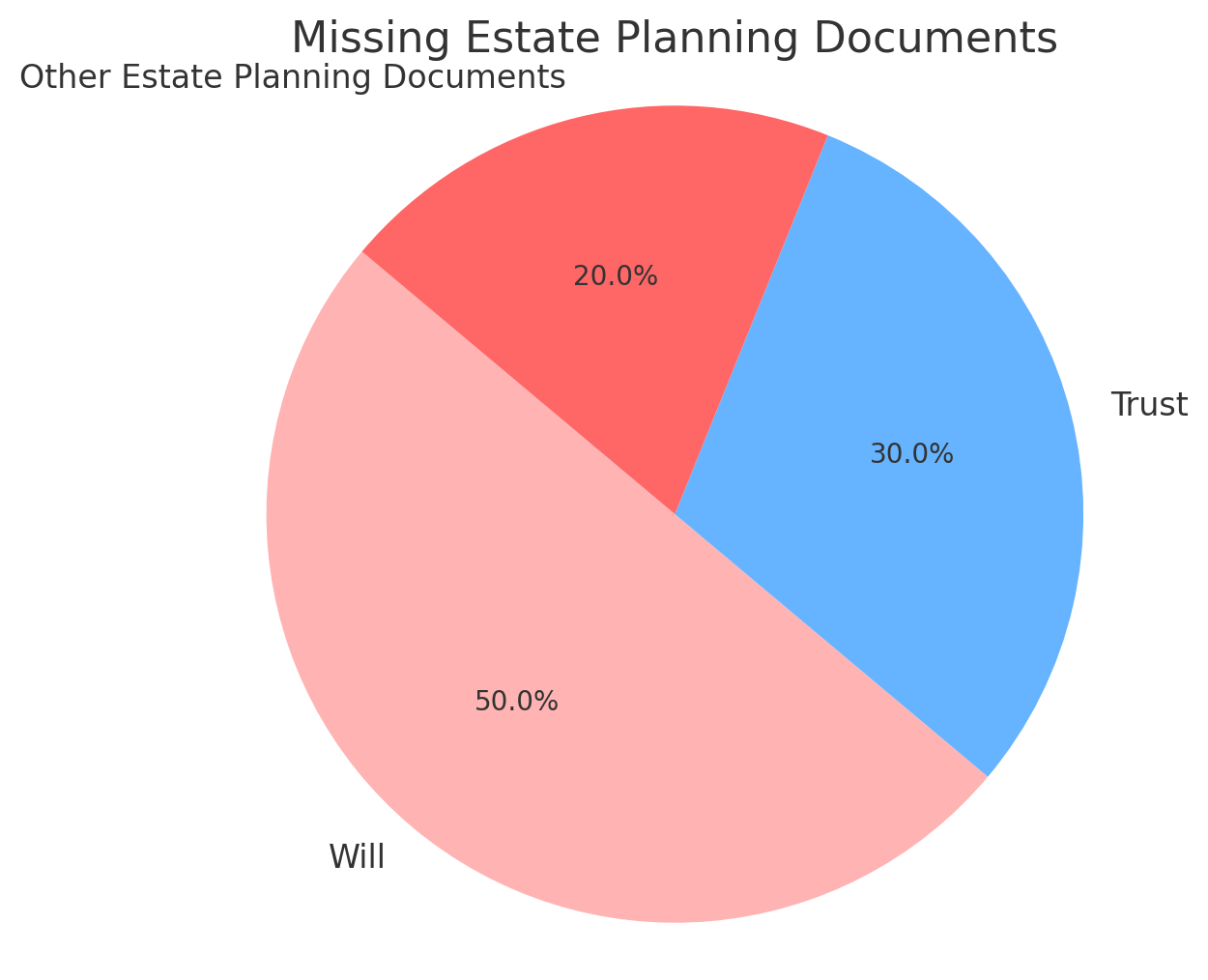

If you’re one of the 43% of Americans who don’t have a will, you should seek out an estate planning lawyer Louisiana. Even if you do have a will, it may not be compliant with Louisiana law or it could be outdated and need to be amended to reflect changes in your life, such as marriage or divorce, or new children in your family. An estate planning lawyer can also help you with any other legal issues that come up during your life and are related to wills and probate laws, such as making health care decisions in case of incapacitation or finding missing heirs. Contact a lawyer at Theus Law Offices for help with your case today.

In short, the best time to get an estate plan is now. Whether you are young or old, have a large or small estate, an experienced estate planning attorney can help you create a plan that meets your unique needs and goals, and provides peace of mind for you and your loved ones.

When working with our Louisiana estate planning lawyer, we will guide you in establishing each aspect of the estate plan. Different tools to consider including are:

- Letter of Intent

- The Will

- Advanced Directive

- Power of Attorney

- Beneficiary Designations

- Guardianship Designations

- Living Trust

- Estate Executor

Each of these documents will make up a complete and well-thought-out plan for the future. By taking the time to make important decisions about the future, the estate owner can ensure that they have a voice when they are no longer able to make decisions and that their family and loved ones have a clear roadmap for the future.

Updating Your Estate Plan

Developing an estate plan is a critical step; however, it doesn’t mean it can be set on the back burner and forgotten. Over time, estate plans can become out of date, and estate owners must regularly update their estate plans as life changes occur. Failure to do so can leave the estate plan outdated and, in some cases, lack the necessary details that must be included over time. Regardless of whether there have been any significant life-changing events, an estate plan should be reviewed with a lawyer at least every 3-5 years or; if any of the following have taken place:

- To update beneficiaries

- The birth or adoption of children

- To review the appointed estate executor

- To review the appointed guardian

- The purchase of property

- Marriage or divorce

- You have moved to another state

- Inherited significant wealth

- Had a change in financial circumstance

A person’s life is ever-changing, and because of this, an estate plan is reviewed and updated per the changes in their life. Our Louisiana estate planning lawyer can assist in reviewing these documents and ensuring they still reflect your wishes.

Choosing Beneficiaries

As an estate planning lawyer Louisiana families trust at Theus Law Offices explains, beneficiaries are individuals or charitable organizations that you want to give some or all of your assets upon your death. Beneficiaries can be any person or charity that means something to you in your life. Ultimately, the people you choose to have assets should be those who will cherish your gift to them and hold you in high regard. We understand that there are family dynamics to consider, and there may be people who you absolutely do not want to receive a portion of your estate. Your lawyer can help you draft a document to state that these individuals are not to be awarded anything, even if they come forward to contest your will and wishes.

Beneficiary Designations

Beneficiaries are individuals or entities you designate to receive your assets after your death. These designations are commonly made in wills, trusts, life insurance policies, retirement accounts, and other financial instruments. It's vital to clearly identify each beneficiary to avoid any confusion or legal disputes.

Importance Of Accurate Designations

Incorrect or outdated beneficiary designations can lead to unintended consequences, such as assets being distributed to ex-spouses or estranged relatives. Regularly reviewing and updating your designations is crucial, especially after significant life events like marriage, divorce, birth of a child, or death of a family member.

Special Considerations In Louisiana

Louisiana's legal system, influenced by the Napoleonic Code, differs from other U.S. states. For instance, Louisiana has unique rules regarding forced heirship, community property, and usufructs, impacting how you can distribute your assets. Working with a knowledgeable attorney like ours at Theus Law Offices helps ensure that your estate plan complies with state-specific regulations.

Choosing The Right Beneficiaries

Selecting beneficiaries often involves personal decisions and requires careful consideration of your relationships, the needs of potential beneficiaries, and your overall estate planning goals. You may also consider naming alternate beneficiaries in case your primary choices predecease you.

Trusts And Minors As Beneficiaries

If beneficiaries are minors, setting up a trust can be a prudent choice. Trusts allow you to appoint a trustee to manage the assets on behalf of the minors until they reach a specified age. Theus Law Offices can help you establish a trust that aligns with your objectives and provides for minor beneficiaries effectively.

Charitable Giving

Many individuals choose to include charitable organizations as beneficiaries in their estate plans. This can be a way to leave a lasting legacy and potentially gain tax benefits. Our team at Theus Law Offices can guide you through incorporating charitable giving into your estate plan.

Estate Taxes And Beneficiary Designations

In some cases, your estate may be subject to federal and state estate taxes. Careful planning is needed to minimize the tax burden on your beneficiaries. We at Theus Law Offices can provide strategies to help reduce or eliminate estate tax liabilities.

Factors To Consider In Your Estate Plan

Creating an estate plan is a vital step in safeguarding your assets, providing for your loved ones, and ensuring your wishes are carried out after your passing. While many individuals tend to postpone estate planning, it's crucial to understand that it is never too early to start preparing for the future. By engaging in estate planning early on, you can gain peace of mind and be confident that your affairs are in order. This article aims to shed light on when you should consider getting an estate plan, emphasizing the importance of proactive planning.

- Major Life Events

Significant life events often trigger the need for estate planning. These events include getting married, having children, purchasing property, starting a business, or receiving a substantial inheritance. Each of these milestones brings new responsibilities and assets that should be accounted for in your estate plan. By addressing these changes promptly, you can ensure that your loved ones are protected and your assets are distributed according to your wishes.

- Age And Health

While age may not be the sole determining factor, it is generally advisable to start estate planning as soon as you become an adult. As life progresses, health concerns may arise, making it crucial to have an estate plan in place. Medical directives, powers of attorney, and long-term care provisions are essential elements to consider when contemplating your estate plan, particularly if you have specific wishes regarding your medical treatment or require assistance with decision-making due to declining health.

- Financial Stability

If you have accumulated significant assets or have a complex financial situation, it is prudent to establish an estate plan. Whether it involves real estate, investments, retirement accounts, or valuable possessions, an estate plan will enable you to articulate how these assets should be managed and distributed after your passing. It can also help minimize taxes and maximize the value of your estate for future generations.

- Business Ownership

If you own a business, proper estate planning is essential for its continuity and the protection of your family's interests. It ensures a smooth transition of ownership, prevents conflicts among heirs, and provides for the financial security of your loved ones. An estate plan can outline who will manage or inherit your business and how its assets and obligations will be handled.

- Changes In Legislation

Tax laws and regulations related to estate planning are subject to change over time. Staying informed about such changes and periodically reviewing your estate plan is crucial to ensure it remains up to date and aligned with current legal requirements. Consulting an experienced estate planning attorney can help you navigate any changes in legislation and make the necessary adjustments to your plan.

Estate planning is a vital task that should not be delayed. Whether you are young or older, have significant assets or not, engaging in estate planning allows you to protect your loved ones, preserve your assets, and maintain control over your future. By seeking the guidance of an experienced estate planning attorney, you can tailor your plan to your specific needs and ensure that it reflects your wishes. Remember, the best time to get an estate plan is now.

Louisiana Estate Planning Infographic

Louisiana Estate Planning Statistics

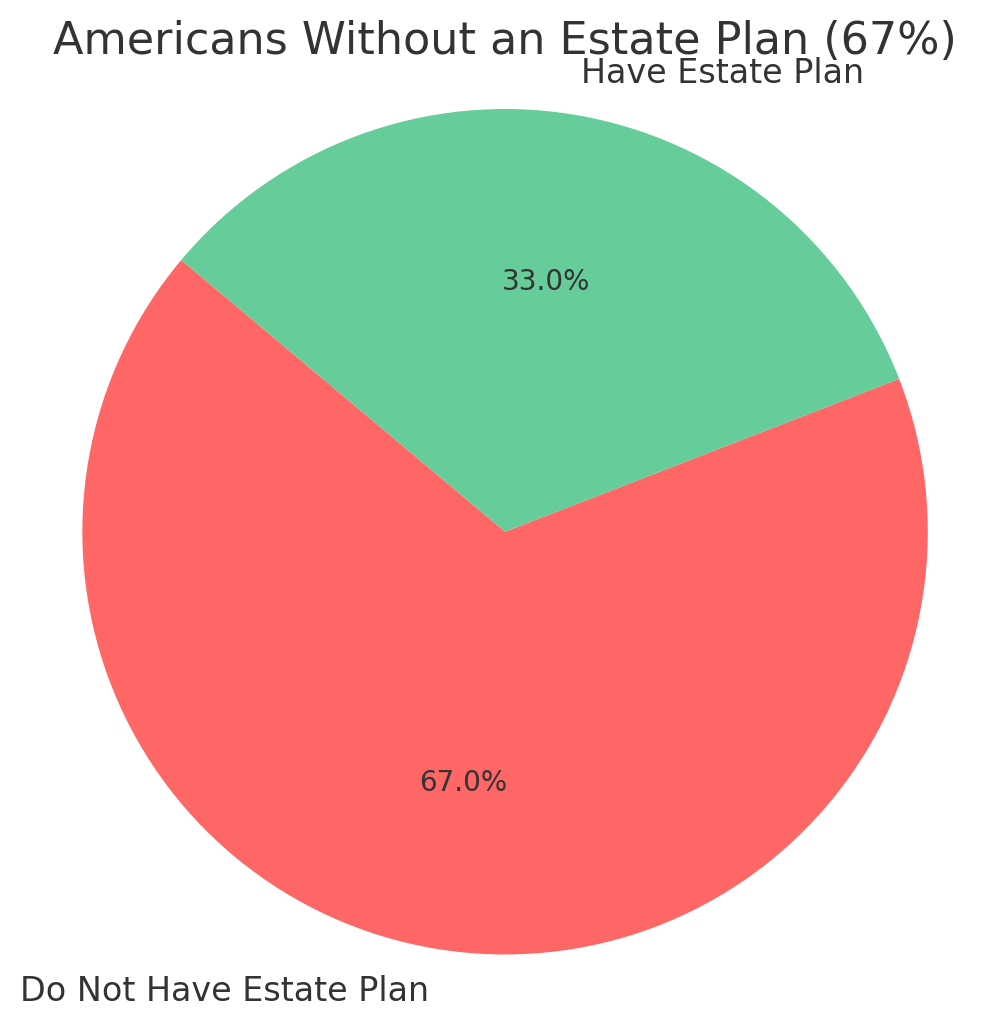

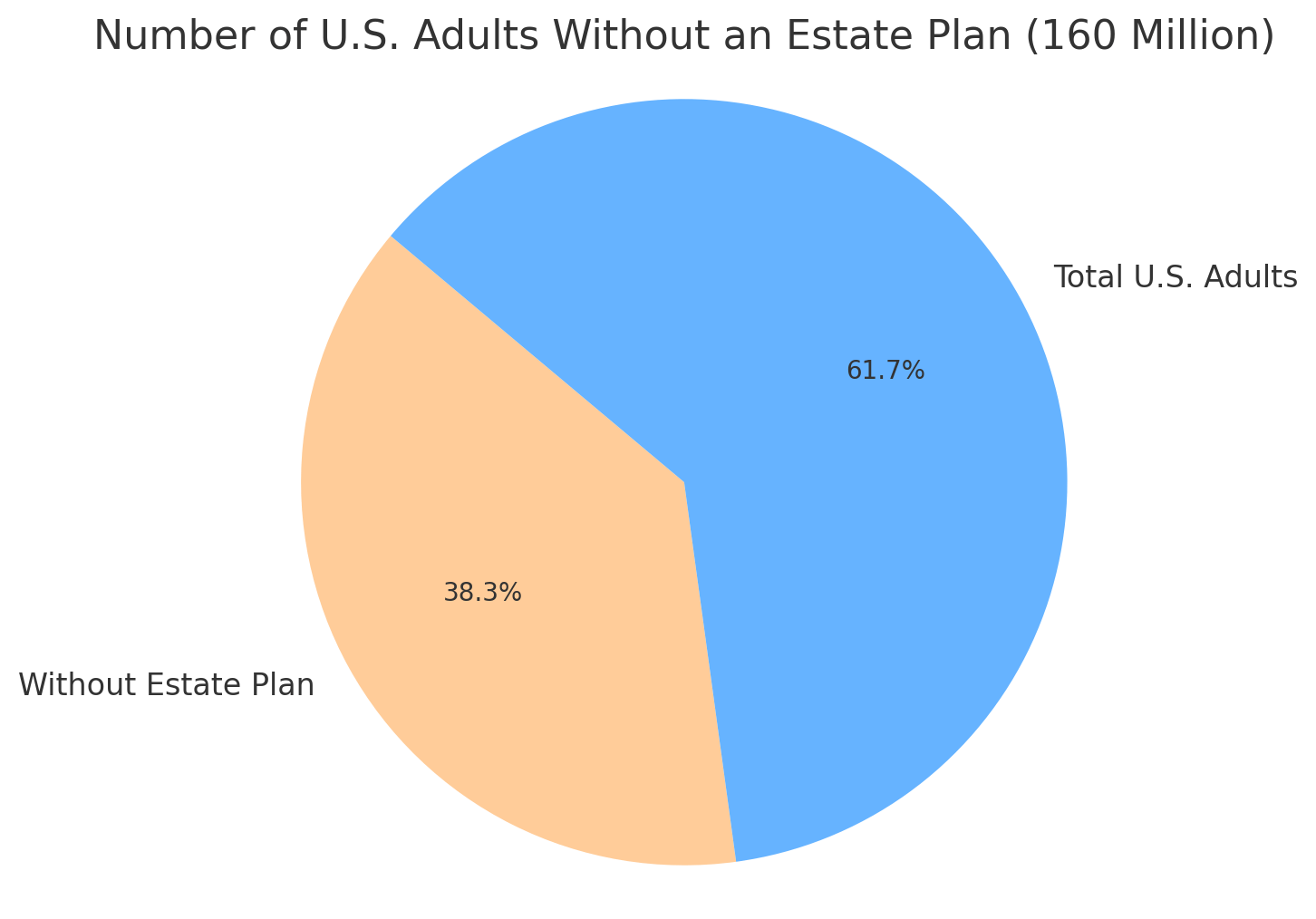

According to a 2022 survey by the National Endowment for Financial Education, 67% of Americans do not have an estate plan. This means that over 160 million adults in the US do not have a will, trust, or other estate planning documents.

Estate Planning FAQs

Estate Planning FAQs

What are common types of living trusts available?

Two primary types of trusts are available, revocable and irrevocable. While a revocable trust can be modified throughout a person’s lifetime, typically once an irrevocable trust is created, there are few exceptions to updating it. A living trust can be either revocable or irrevocable and can take on many forms depending on the needs of the person developing the trust.

Is a living trust the best way to reduce the number of assets that may pass through probate?

Many assets may pass through the probate process when a person passes away. However, when assets are transferred out of a person’s ownership and into a trust, the assets within the trust can circumvent the number of assets that will pass through probate.

Developing a living trust will require extensive planning and paperwork, and it will be necessary to have help from a legal professional with experience in this practice area. A living trust can allow the creator to outline their wishes privately and clearly.

If you are thinking about establishing an estate plan, you may want to consult with our Louisiana estate planning attorney at Theus Law Offices. The planning process can be quite complex, so you want someone knowledgeable and experienced on your side. A skilled lawyer can help you establish a proper estate plan that clearly states your wishes.

Who needs estate planning?

It is still frequently assumed that estate planning is just for the wealthy. However, it turns out that estate planning is beneficial for people of all ages and income levels. Even younger people with modest assets should consider creating a proper estate plan. With an estate plan, you can decide how you want your property distributed, who will be the legal guardian of your minor children, and who will make healthcare decisions on your behalf.

What will happen if I do not have an estate plan?

If you die before having a proper estate plan in place, your assets will pass according to your state’s law of intestacy. In Louisiana, your community property will be distributed first to your spouse. Your spouse and children will receive part of your separate property. If you do not have a living spouse or children, your property may go to other relatives, like parents, siblings, nieces, and nephews. If you do not have any remaining relatives, the state may get your property.

Should I leave property equally among my children?

The answer to this question highly depends on your individual situation. However, you are not obligated to give equal inheritances to your children. For example, if one child has more financial problems than your other children, you may choose to give the child a bigger inheritance. If you decide to go this route, you may want to have a conversation with your children ahead of time. Explain why you made the decision you did and be willing to answer all of their questions. If your children understand your reasoning, they may accept your decision better.

Louisiana Estate Planning Glossary

For anyone navigating the complexities of estate planning, our experienced Louisiana estate planning lawyer can provide vital guidance and ensure the necessary legal documents are prepared properly. Estate planning is the process of organizing the management and distribution of an individual's assets during their life and after death. We value open communication and collaboration with our clients. Below are several key legal terms commonly used in estate planning.

Letter Of Intent

A Letter of Intent is a non-legally binding document that communicates a person’s intentions and wishes for their estate. While it does not hold the weight of a will, it is often used to provide instructions to loved ones or the executor of an estate regarding personal wishes, such as funeral arrangements or the care of dependents. The letter serves as a guide for the executor in making decisions that align with the individual’s values and preferences.

Power Of Attorney

A Power of Attorney (POA) is a legal document that allows one person (the principal) to authorize another person (the agent) to act on their behalf in specific matters, typically concerning legal, financial, or medical decisions. The agent's authority can be broad or limited to particular tasks, depending on the terms of the agreement. This tool ensures that someone trusted can manage important matters when the principal is unable to do so due to illness, absence, or incapacity.

Beneficiary Designations

Beneficiary Designations are used to specify who will receive certain assets upon a person’s death, such as life insurance proceeds, retirement accounts, or bank accounts. Unlike assets that are distributed through a will or trust, beneficiary designations bypass the probate process, ensuring a quicker transfer of assets to the designated individuals or organizations. It is important to regularly update these designations to reflect life changes, such as marriage, divorce, or the birth of children.

Estate Executor

An Estate Executor is the person or institution appointed by a decedent to manage their estate. The executor’s responsibilities include overseeing the distribution of assets, paying off debts, and ensuring that the decedent’s wishes, as outlined in their will, are carried out. This role is crucial in ensuring the orderly transfer of assets and the legal administration of the estate, and it may involve coordination with our Louisiana estate lawyer and financial institutions.

Living Trust

A Living Trust is a legal document created during an individual's lifetime that transfers ownership of their assets into the trust for the benefit of designated beneficiaries. The individual acting as the trustee retains control of the assets during their lifetime, but upon death, the assets are passed on to beneficiaries without going through the probate process. This type of trust provides flexibility and privacy, and it can be structured to accommodate a variety of estate planning needs, such as minimizing taxes or protecting assets from creditors.

Theus Law Offices

1902 Jackson St, Alexandria, Louisiana 71301

Contact Our Firm Today

Estate planning is a crucial process that should not be overlooked. Regardless of the size or complexity of your estate, it is important to have a plan in place that provides for the smooth transfer of assets to your loved ones and ensures that your wishes are carried out. At Theus Law Offices, we understand the importance of estate planning and are dedicated to helping our clients create a comprehensive plan that meets their unique needs and goals.

We have extensive experience in all areas of estate planning, including wills, trusts, powers of attorney, and advance directives. We have helped countless individuals and families protect their assets and achieve their estate planning goals, and we are committed to providing our clients with the highest level of service and support. If you are in need of estate planning services, we encourage you to contact us today to schedule a consultation. We look forward to helping you achieve peace of mind and protect your legacy for future generations.

Our firm is dedicated to helping our clients achieve their goals and protect their assets for future generations. We can help you create a comprehensive estate plan that provides peace of mind and ensures that your wishes are carried out. Call today to get started.

Estate Planning FAQs

Estate Planning FAQs