Louisiana estate planning blog

Blog

Because of COVID-19, College-Aged Children Need a Basic Estate Plan

Fortify Your Estate Plan Against Undue Influence Claims

Run the Numbers Before You Extend Customer Credit

A SLAT Offers Estate Planning Benefits and Acts as a Financial Backup Plan

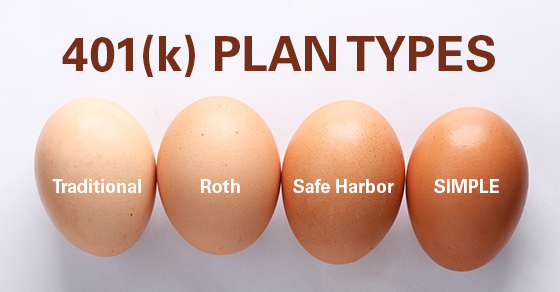

Finding a 401(k) That’s Right for Your Business

The BDIT: A Trust With a Twist

Client Reviews

Octave A.

“We appreciate all the help and explanations to get the trust set up. It took such a short time to accomplish compared to just taking the first step! We would recommend the firm without hesitation. Thank you!”

Leonard K.

“Positive experience. They did a professional job. Very helpful and personable.”

Ted R.

“Graves helped with our estate planning and did an excellent job!”

Ron H.

“Graves handles my personal real estate law and is the best, hands down. He is VERY thorough and efficient. I highly recommend him!”

Maurice H.

“Graves has experience with all types of real estate law and we have used his firm for many years. He is honest, thorough, accurate, detailed and timely.”

Principal

Managing Attorney

From Our Blog

Because of COVID-19, College-Aged Children Need a Basic Estate Plan

Fortify Your Estate Plan Against Undue Influence Claims

Run the Numbers Before You Extend Customer Credit

A SLAT Offers Estate Planning Benefits and Acts as a Financial Backup Plan

Finding a 401(k) That’s Right for Your Business

The BDIT: A Trust With a Twist

Serving clients nationally

Serving Louisiana, Washington, & Alaska

with office locations in:

- ALEXANDRIA

- LAFAYETTE

- SHREVEPORT

- NEW ORLEANS

- BATON ROUGE

- MONROE

- SEATTLE

- ANCHORAGE

Consultation