If you’re looking for legal assistance with your estate plan, our Shreveport, LA estate planning lawyer is here to help. Reaching out to our attorney is the first step to being prepared for any emergency, and it can greatly benefit your friends and family. No matter how old you are, or how stable your health is, planning an estate is an important process that informs your loved ones how to proceed in the event of your death or incapacitation. An unexpected death can cause a crush of emotions that can cloud judgment and split families and friends apart, so it’s imperative to do all you can to prevent the stress, frustration, and anger, that can complicate the process of dividing your estate to your beneficiaries. Contact our team at Theus Law Offices today to schedule your free 15-minute consultation.

Table of Contents

- If You Do Not Have a Will

- Components of a Comprehensive Estate Plan

- 4 Common Estate Planning Mistakes

- Shreveport Estate Planning Infographic

- Shreveport Estate Planning Statistics

- Shreveport Estate Planning FAQs

- Theus Law Offices, Shreveport Estate Planning Lawyer

- Contact Our Shreveport Estate Planning Lawyer Today

Death isn’t something many of us like to think about – especially our own. However, it’s important to remember that when you plan your estate, you’re doing it for more than just your peace of mind. Verifying your estate is properly planned out makes processing your passing much easier for your family and friends, and it is the best way to confirm the right people are awarded the right assets once you’re gone. Without a properly planned estate, your loved ones will have a much more difficult time dealing with your belongings, investments, and debts.

If You Do Not Have a Will

If you fail to draft a will there may be a bitter battle for any inheritance you leave behind. A will establishes who has durable power of attorney by establishing who is in charge of confirming the assets are divided up properly between beneficiaries. A will also establish beneficiaries, and without any instructions to follow after your death, your assets will go right into the hands of the state. This doesn’t mean the state will own everything you’ve worked hard for – but it does mean the state has the authority to distribute your assets however it sees fit.

The state usually appoints a representative to distribute your assets if you have failed to draft a will. While this is typically a spouse or a child, things get complicated if you are ever divorced. If you went through a particularly bitter divorce, but later remarried, who should have the right to choose your beneficiaries and to distribute your assets – your ex, or your most recent spouse? In the eyes of the state, the answer may not be as clear as you’d hope. Fortunately, if you reach out to our Shreveport estate planning lawyer, you can make sure this sort of difficulty never surfaces.

Understanding Louisiana Intestate Laws

You may also be asking what happens if you die without a will because you are aware of the Louisiana Intestate laws. Intestate laws mean that your estate will be handled by shifting the assets and distributing them starting first with children and spouse, before going through extended family. The exact application of Louisiana estate planning laws depends on two factors, whether the decedent’s property is community property or separate, and whether the decedent had a close enough relationship to the family member.

But this is going to raise new questions such as what is community property or separate property? The answer to this is, that Louisiana is one of a handful of states that have a community property system for the ownership of property. Under this particular system, a person’s assets are grouped into categories of either community or separate. If a person is or has been married, you must first analyze which assets are a community in which assets are separate.

If a person dies without a will in Louisiana, their separate property is distributed among their relatives. First, it goes to the decedent’s children or their spouse. If the deceased children are also deceased, the descendants will inherit by roots. This means that the deceased child’s descendants will share equally in the share that their deceased parent should have taken if their parent has died and has no children surviving. So effectively your grandchildren would have a first claim in the effect that you have no living children

If you have no surviving descendants but you have the surviving parents or siblings the property that is considered separate property passes to the decedent’s parents. Should you only have surviving siblings the siblings will share equally in your property.

But just what does this mean for community property in Louisiana? A deceased person’s property which is defined as community property will be distributed to hit their spouse or just send it depending on the family situation. If you have a surviving spouse, the property will pass to the spouse. Community property passes the surviving spouse as something called a life estate. This ends when the surviving spouse dies or remarries, and then it passes to the children. Should you have a surviving spouse but no surviving descendants the community property passes entirely to a surviving spouse.

But now you may be wondering if any valuable assets do not have to go through intestate laws in Louisiana. The answer is yes. If you have transferred your property to a living trust, it will not be affected by succession laws. Life insurance proceeds, funds, and an IRA, 401k, or another type of retirement account, payable on death bank accounts and property that you own with somebody else in joint tenancy will not fall under succession law. There are always exceptions to these rules and you should always talk to our estate planning attorney to confirm that your rights are protected.

Components of a Comprehensive Estate Plan

There are several elements that, together, make up the foundation of a comprehensive estate plan. Certainly, if you own high-value assets or have a particularly complicated portfolio, your estate plan may be extensive. However, most legally independent adults should have the following updated documents in place at all times, regardless of whether they own substantially valuable property or not:

- A will and/or living trust

- An advance healthcare directive

- Power of attorney designations, including medical, financial, and/or general

- Guardianship designations for minor children, dependent adult children, and/or pets

- Digital estate planning instructions

Additionally, it is generally a good idea to name an estate administrator (and some alternate choices in case your first pick cannot or will not fulfill this role) in your estate plan so that there is no question as to whom you wish to manage your affairs after you’re gone.

The Best Time to Hire an Estate Planning Lawyer

Many financial advisors recommend the best time to begin estate planning is the moment that you become a legal adult and update it every three to five years after that. For most young adults an estate plan is the last thing on their mind, but it can be an important tool since you have now become solely responsible for your finances, healthcare, and power of attorney. Not to mention, you will begin purchasing assets that are yours and should make sure that everything is accounted for.

However, if you don’t find it necessary to begin estate planning as a young adult there are a few life milestones that should encourage you to reach out to our lawyers to help guide you through the process of planning for the future. Those life milestones include:

- Once you start a savings account

- The purchase of a home or other property

- Marriage and remarriage

- Before big traveling trips or if you go out of the country or travel for a long period

- First child and after any additional child

- Any additional money or assets that you inherit

- Divorce

- Grandchildren or births in the family

These types of milestones should be when you meet with our professionals at Theus Law Offices to guarantee that everything in your estate is accounted for and planned for. These milestones can increase your wealth or impact the way that you would like your assets distributed after death.

Estate planning is one of the most important things that you could end up doing in your life to protect yourself, your family, and the future. The creation of a Will or designation of a guardian for your children can help make sure that your wishes will be followed after death.

Our estate planning attorney has been trained in how to help you legally plan for what happens to your assets after you die or if you find yourself in a situation where you are unable to take care of yourself. Our lawyer has the skills and knowledge in wills, trusts, and your local probate process. We understand the law and have helped many clients plan out their future and establish that their wishes will be carried out after death.

It can be difficult thinking about a future that doesn’t involve you, but sometimes it is the best thing you can do for the people that you care the most about. Your family and friends won’t have to go through the stress of figuring out what you may or may not have wanted to do with your assets. There are a lot of legal complications that only our lawyer will know about. We can guarantee that your wishes will be met and that your family and friends will be taken care of after death. It isn’t the easiest topic to talk about, but it is a smart one.

4 Common Estate Planning Mistakes

Estate planning can be confusing and complicated, but avoiding it altogether is the worst mistake of all. Sadly, we don't live forever, but some of our cash and assets do live on. It's important to make a detailed procedure about who gets to control these things just in case something happens to us and we are no longer able to. Here are some of the more common mistakes you could make regarding the world of wills and estates.

- Waiting Too Long

If you're 30 or older someone has likely suggested to you by now how important it is to write a will, especially if you have kids, real estate, or you own a business. Truth is, an accident can occur at any time which could render you unable to control your property anymore. Speaking with our succession lawyer should be considered an indispensable step of the process so that your documentation complies with state law.

- Making Poor Choices

If a procedure in your estate plan requires trusts or annuities, you will need to choose a person who can be the executor of that section of your assets. Choosing an executor who turns out to be unable to fulfill that duty can leave your family in serious trouble. Our reputable firm has experience with this sort of procedural law and could offer some guidance. The idea should be to leave your family with wealth, safety, and comfort - not headaches and legal fees.

- Losing Your Will

Believe it or not, some people go through the trouble of making a will, only to accidentally hide it so their family can't find the documents after their death. The state is required to involve themselves if a will can't be found. The last thing you want is for the state to get involved. Make sure your loved ones know where the documents are kept which inform how to begin the estate plan.

- Misaligning Life Insurance

An important reason to choose our estate law firm is that your life insurance could inadvertently trigger an estate tax. Proceeds of a life insurance policy shouldn't be taxed as income, but they could be subject to estate taxation if certain conditions exist. Our professionals have experience with these elements of the law and should be consulted when planning out a sound estate plan.

Shreveport Estate Planning Infographic

Shreveport Estate Planning Statistics

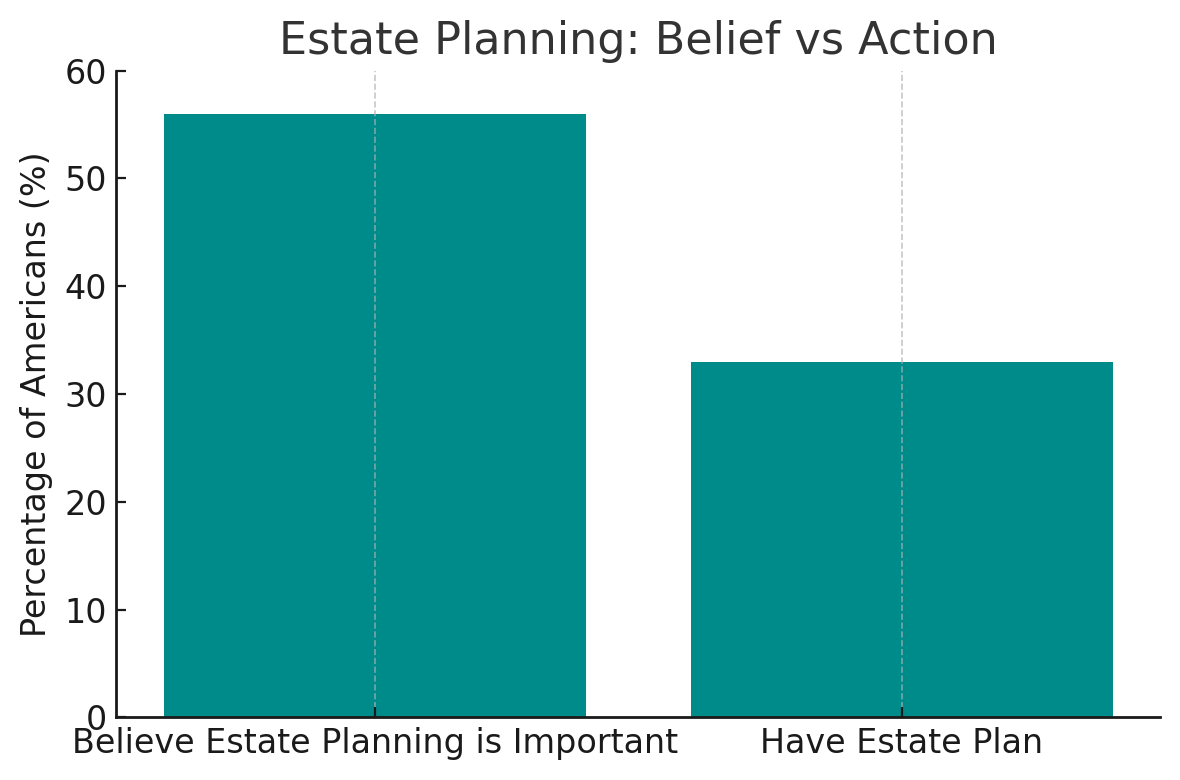

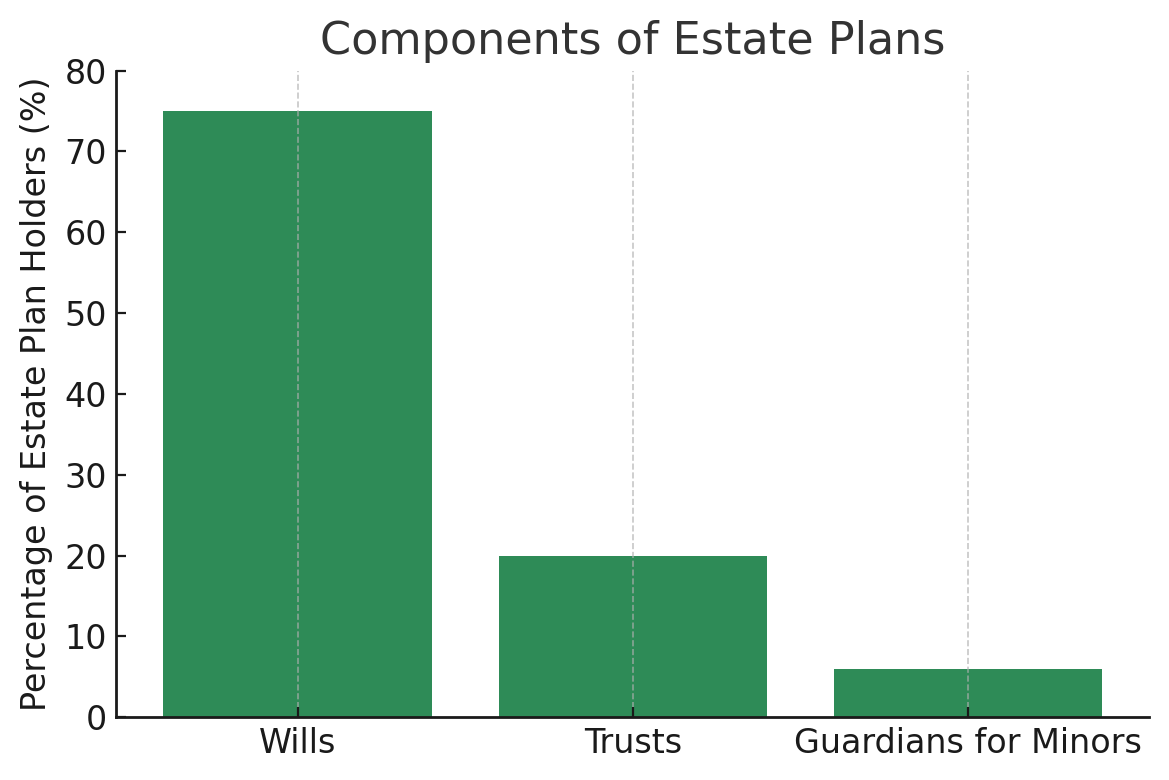

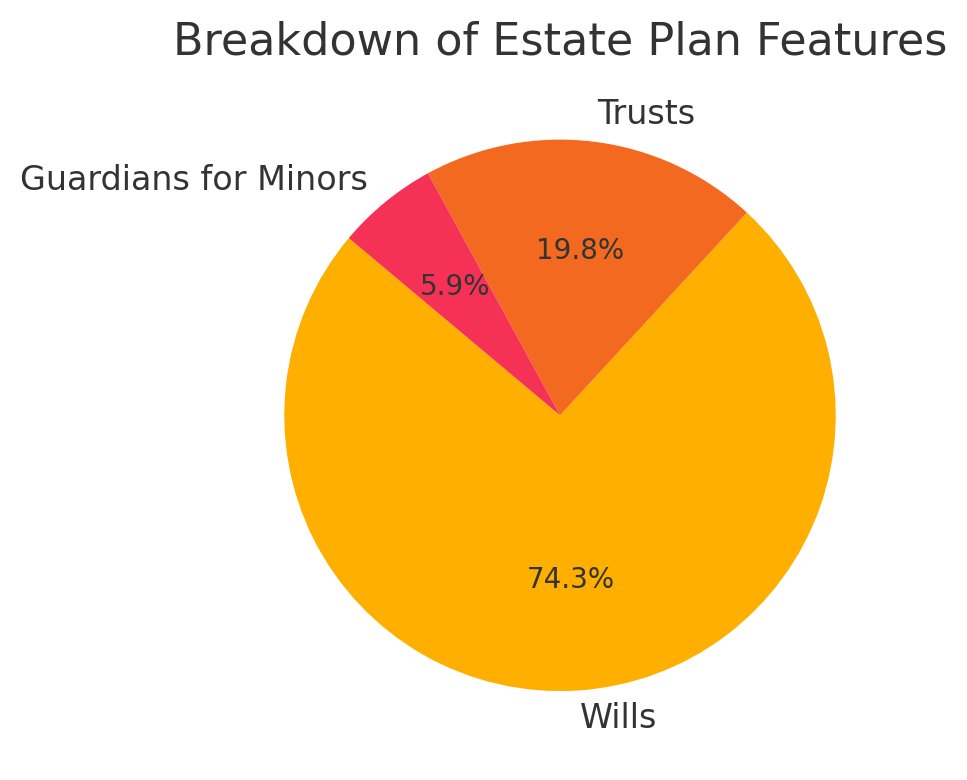

According to a survey conducted by Caring.com, even though 56 percent of Americans believe estate planning is important, only 33 percent have taken the steps to establish end-of-life plans. For those who do have an estate plan in place, 75 percent have drawn up wills, 20 percent have set up trusts, and 6 percent involved the naming of guardians for minor children. To learn more about estate planning, call our office to meet with our estate planning attorney.

Estate Planning FAQs

Estate Planning FAQs

If you need assistance with your estate plan, contact our Shreveport estate planning lawyer. Estate planning can be a complicated process. Here are some frequently asked questions and answers about estate planning lawyers.

What Is An Estate Planning Lawyer, And What Do They Do?

An estate planning lawyer is a legal professional who specializes in helping individuals manage and distribute their assets upon death or incapacitation. Our primary role involves creating comprehensive plans that confirm the smooth transfer of wealth to intended beneficiaries while minimizing tax liabilities.

Why Is Estate Planning Important?

Estate planning is paramount for several reasons. It allows individuals to dictate how their assets should be distributed, appoint guardians for minor children, and minimize the impact of taxes and probate costs. Without proper planning, the distribution of assets may be subject to legal complications, leading to unintended consequences.

What Services Do Estate Planning Lawyers Offer?

Estate planning lawyers provide a range of services, including drafting wills, establishing trusts, creating powers of attorney, and developing healthcare directives. We also offer advice on tax planning, asset protection, and strategies to avoid or minimize probate.

How Does A Will Differ From A Trust, And Which Is Better?

A will is a legal document that outlines how a person's assets should be distributed after death, while a trust is a legal entity that holds and manages assets for the benefit of specific individuals. The choice between a will and a trust depends on individual circumstances, with trusts often offering additional benefits such as privacy and the avoidance of probate.

When Should I Start Estate Planning?

It's advisable to start estate planning as soon as you have assets or dependents. However, it's never too late to begin the process. Life changes, such as marriage, the birth of children, or the acquisition of significant assets, should prompt a review and potential update of your estate plan.

How Can Estate Planning Help With Tax Reduction?

Our attorneys employ various estate planning strategies to minimize tax liabilities, such as establishing trusts, gifting assets, and taking advantage of applicable tax exemptions. Proper planning can help guarantee that the maximum value of assets passes to beneficiaries rather than being eroded by taxes.

What Happens If I Don't Have An Estate Plan?

Without an estate plan, the distribution of your assets will be subject to the laws of intestacy, which may not align with your wishes. This can lead to lengthy legal processes, family disputes, and potentially higher tax liabilities. Estate planning allows you to maintain control over and plan your legacy.

Can I Create An Estate Plan Without A Lawyer?

While it's possible to create a basic estate plan using online tools, consulting with our estate planning lawyers is highly recommended. We can provide personalized advice based on your specific circumstances, confirming that your plan is legally sound and addresses all relevant considerations.

How Often Should I Update My Estate Plan?

It's advisable to review your estate plan regularly, especially after significant life events such as marriages, divorces, births, or the acquisition of substantial assets. Regular updates help confirm that your plan remains aligned with your current circumstances and goals.

Shreveport Estate Planning Glossary

Working with our experienced Shreveport, LA estate planning lawyer at Theus Law Offices can help you make your estate plan legally enforceable and make sure your assets are distributed per your desires. We provides clients with the estate planning tools and guidance necessary to make informed decisions for the future. Creating an estate plan isn’t just about protecting property; it’s about protecting relationships, easing stress, and maintaining control over what happens next. Below are several key terms we often address with clients. These are specific to Louisiana’s estate planning process and reflect important legal concepts you should understand when preparing your estate.

Will

A will is a legal document that specifies how a person’s assets should be distributed upon their death. It also allows the individual to name an executor who will oversee the distribution process and confirm that the instructions are followed. A will can address the distribution of property, care of minor children, and other important matters, making it a fundamental tool in estate planning. It’s important to regularly update your will to reflect any changes in your circumstances, such as the birth of children, marriage, or the acquisition of new assets.

Power Of Attorney

A power of attorney is a legal document that grants one person the authority to make decisions on behalf of another. This could include financial decisions, medical choices, or legal matters. The individual who is granted this authority is known as the "agent" or "attorney-in-fact." There are different types of power of attorney, such as durable (which remains in effect even if the principal becomes incapacitated) and limited (which only grants authority for specific actions). According to our Shreveport estate planning lawyer, it’s critical to choose a trusted agent who will act in your best interests.

Trust

A trust is a legal arrangement where one party, called the trustee, holds and manages assets for the benefit of another, known as the beneficiary. Trusts are often used to avoid probate, provide for minor children or loved ones with special needs, or protect assets from creditors. The person who creates the trust is known as the grantor or settlor. There are various types of trusts, such as living trusts (which are created during the lifetime of the grantor) and testamentary trusts (which are created through a will upon the grantor's death). Trusts offer flexibility and control over how and when assets are distributed.

Community Property

Community property is a legal concept that applies in certain states, like Louisiana, where assets acquired during a marriage are considered jointly owned by both spouses, regardless of who earned or purchased the property. This includes income, real estate, and other assets acquired during the marriage. In the event of divorce or the death of one spouse, the property is generally divided equally. Estate planning in community property states requires special consideration, as it impacts how assets are distributed upon death and how taxes are managed.

Separate Property

Separate property includes assets that one spouse owned before marriage or received individually through inheritance or gift. These assets remain solely in the name of that individual and are not typically subject to division as community property. In Louisiana estate planning, correctly classifying assets as separate or community is essential for accurate asset distribution. If someone dies without a will, their separate property may pass directly to their children, or if none are living, to other relatives such as parents or siblings. Knowing how your property is classified helps avoid confusion and potential disputes later.

Usufruct

Usufruct is a legal term used in Louisiana to describe a temporary right given to someone (usually a surviving spouse) to use property that belongs to someone else—typically, their deceased spouse’s estate. While the usufructuary does not own the property outright, they can live in it, collect income from it, or otherwise benefit from it until their death or remarriage. After this period, ownership passes to the naked owner, often the children or other heirs of the deceased. Establishing usufruct in an estate plan allows for smoother transitions in property use while maintaining intended ownership rights.

Intestate

When someone dies without a valid will, they are considered to have died "intestate." In this situation, their estate will be distributed according to the state’s intestacy laws, which vary by jurisdiction. Typically, these laws prioritize distribution to the deceased's spouse, children, or other close relatives. Dying intestate can lead to outcomes that may not align with the deceased's wishes, making it essential to have a well-drafted will in place. Our skilled Shreveport estate planning attorney can help prevent family disputes and make sure your estate is managed according to your desires.

Living Trust

A living trust is a legal arrangement created during a person’s lifetime to manage and distribute their assets. Unlike a will, a living trust allows property to bypass probate entirely, which can save time and reduce costs. The person who creates the trust, called the grantor, places assets into the trust and appoints a trustee to manage them. The grantor often acts as the trustee during their lifetime and names a successor to manage or distribute the trust after their death. In Louisiana, using a living trust can be a highly effective way to keep your estate private and facilitate a more direct transition of property to beneficiaries.

Theus Law Offices, Shreveport Estate Planning Lawyer

910 Pierremont Rd, Shreveport, LA 71106

Contact Our Shreveport Estate Planning Lawyer Today

If you have not updated your estate plan in some time, if your estate plan is incomplete, or if you have yet to draft an estate plan, connect with our experienced Louisiana legal team at Theus Law Offices today for guidance and support. Having a clear estate plan gives your family clarity when it matters most. Attorney J. Graves Theus has helped individuals and families with their estate planning needs for over twenty years. Contact our team at Theus Law Offices to speak with our Shreveport, LA estate planning lawyer and take the next step toward protecting what matters to you. We look forward to speaking with you.

Client Review

"This is the best person to call for advice. Even when everything feels hopeless he cares enough to give you the best hope he can possibly give you. I would definitely recommend him to anyone. I would hire him if I ever need a lawyer."

Alice K.

Estate Planning FAQs

Estate Planning FAQs