If you’ve ever thought about a living trust, you should talk to a Louisiana trust lawyer about how to go about making one. A living trust may be one of the most misunderstood of all estate planning tools because of several common myths that are floating around.

The truth is, a living trust can be an effective estate planning tool if you understand what it can and can’t accomplish. There are several benefits to having a living trust as part of your estate plan. If you still aren’t sure about a living trust see if one of the myths below is the reason why.

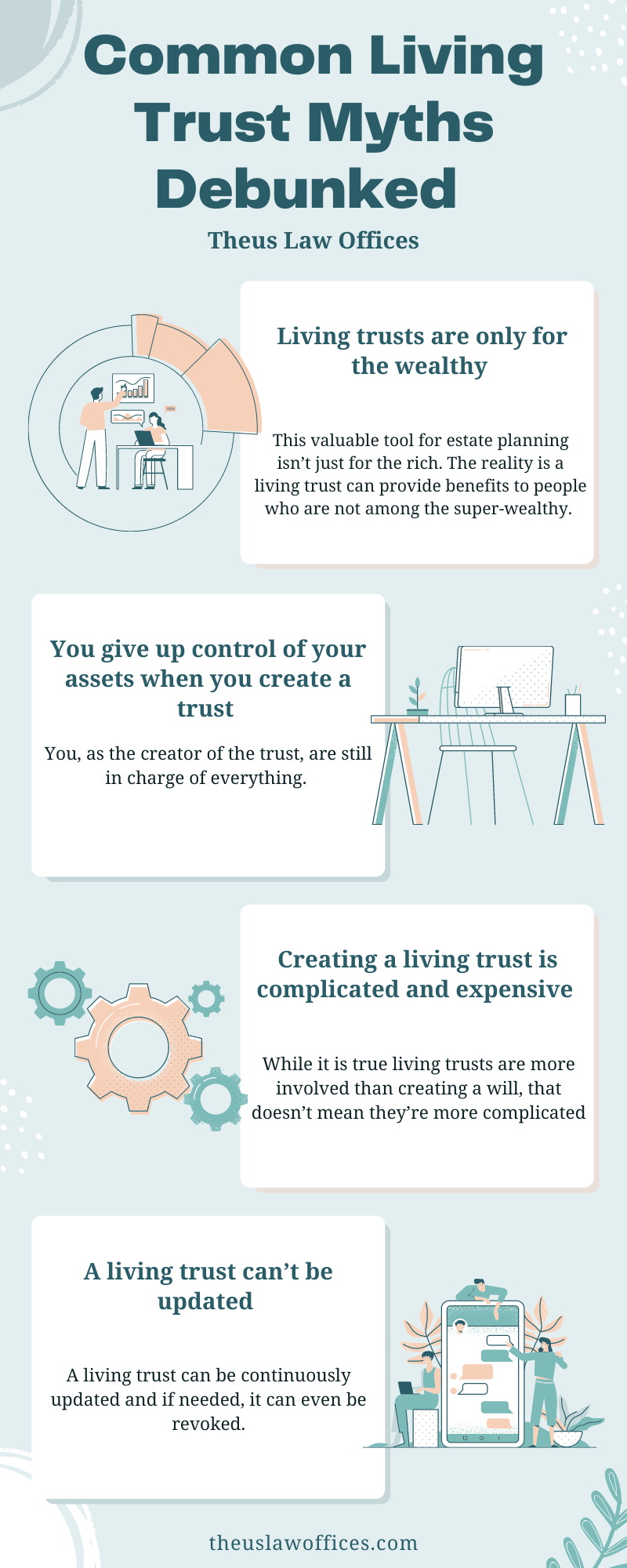

Common Living Trust Myths Debunked

Below are the top 5 myths about a living trust and why they simply just aren’t true.

1. Living trusts are only for the wealthy

This myth is probably the most widely believed but is actually completely false. While yes, many wealthy people set up trusts, it doesn’t mean that you can’t as well. This valuable tool for estate planning isn’t just for the rich. The reality is a living trust can provide benefits to people who are not among the super-wealthy. It is a fantastic foundation for many estate plans and it can protect your family in the event of your untimely death or incapacity.

2. You give up control of your assets when you create a trust

Many people believe that creating a living trust transfers control of assets away from the creator of the trust. You, as the creator of the trust, are still in charge of everything. Once a living trust is created, you maintain control of your assets, including how they are distributed to beneficiaries. You also will have continual access to the funds in a living trust. Because you’re the trustee of your own living trust, there’s nothing that can pop up like someone spending or investing your assets without your knowledge.

3. Creating a living trust is complicated and expensive

While it is true living trusts are more involved than creating a will, that doesn’t mean they’re more complicated. This document has to provide you and your loved ones with benefits like avoiding probate and avoiding core control of assets at incapacity. This is why talking to a Louisiana trust lawyer is a great step to take. It is true the living trust is typically more expensive than the will upfront, but it can actually save you and your loved ones a significant amount of money by avoiding probate expenses.

4. A living trust can’t be updated

The truth is, a living trust can be continuously updated and if needed, it can even be revoked. With the help of an estate planning lawyer, you can modify or revoke your living trust when changes occur in your life and can ensure that your assets are handled correctly and your loved ones are protected.

Louisiana Trust Law Infographic

Contact Our Louisiana Trust Lawyer Today!

If you are considering a living trust, then talking to a trusted Louisiana trust lawyer from the team at Theus Law Offices is a great way to start and you can contact us for a consultation today.