Estate Planning Lawyer Baton Rouge, LA

When it comes to protecting your assets and making sure your family is taken care of in the event of your death, having our experienced Baton Rouge, LA estate planning lawyer can be invaluable. Estate planning is a complicated area of the law, and it’s important to have our qualified professional on your side to help you make sure that your wishes are followed. Learn what our estate planning attorney can do for you and why it’s so important to have one in your corner. Then, contact us at Theus Law Offices for help today. Attorney J. Graves Theus, Jr. has over 20 years of experience helping people and is prepared to help you.

Table of Contents

- What Is Estate Planning

- What Happens If I Don’t Have An Estate Plan

- How Often Should I Update My Estate Plan

- What Are The Benefits Of Having Beneficiaries

- 5 Myths About Estate Planning

- Baton Rouge Estate Planning Infographic

- Estate Planning FAQ

- Contact Our Baton Rouge Estate Planning Lawyer Today!

The Basics of Estate Planning

Estate planning is an important process that involves the preparation of tasks to manage an individual’s asset base in the event of incapacitation or death. The planning includes the bequest of assets to heirs and the settlement of estate taxes. Most estate plans are set up with the assistance of an attorney experienced in estate law.

Estate planning is more than just writing a will. Done effectively, it organizes assets and responsibilities in a way that addresses an individual’s personal circumstances. As life changes, for example, through marriage, divorce, or the birth of children, the estate plan should evolve to reflect these adjustments.

Key Components of Estate Planning

- Wills and Trusts. A will is a legal document dictating the distribution of assets upon death. A trust can be used to begin distributing assets before death, at death, or afterward.

- Power of Attorney. This allows a trusted person to act in an individual’s stead for legal or financial decisions.

- Beneficiary Designations. Determines who will receive specific assets, such as life insurance policies or retirement accounts.

- Guardianship Designations. For those with minor children, this is an important part of the will, allowing for the designation of a guardian.

- Healthcare Power of Attorney. Appoints someone to make medical decisions if the individual is unable to do so.

The Importance of Estate Planning

Without a proper estate plan, the courts will often decide who gets your assets, a process that can take years, rack up fees, and get ugly. By planning your estate, you can maximize your legacy, minimize taxes and make sure that your beneficiaries are taken care of in the best possible way.

We provide excellent guidance for estate planning. Our team of experienced Baton Rouge estate planning lawyers understands that each individual’s situation is unique. We work closely with our clients to develop personalized estate plans that reflect your specific needs and goals.

What Happens If You Don’t Have an Estate Plan

Estate planning is an important aspect of managing your financial life. It makes sure that your assets are distributed according to your wishes after your passing. However, many individuals often overlook this vital step, not realizing the potential consequences of not having an estate plan in place. We have a wealth of experience in estate law and emphasize the importance of having a well-crafted estate plan.

The State Decides on Asset Distribution

Without an estate plan, state laws, known as intestacy laws, will determine how your assets are distributed. Intestacy laws vary by state and generally distribute assets to your closest relatives, such as your spouse, children, or parents. This one-size-fits-all approach may not align with your personal wishes and could lead to outcomes you never intended.

Potential for Family Conflicts

When there is no clear directive on how to distribute your assets, conflicts can arise among family members. These disputes can be emotionally draining and can lead to lasting rifts within the family. By having an estate plan, you provide clear guidance, which can help prevent misunderstandings and disputes among your loved ones.

Guardianship Issues

For those with minor children, an estate plan allows you to appoint a guardian. Without an estate plan, the court will decide who will care for your children if both parents are deceased or incapacitated. This decision may not reflect your desires or your children’s best interests.

Probate Delays and Expenses

Without an estate plan, your estate will go through probate, a legal process that can be time-consuming and expensive. Probate involves validating your will, paying off debts and taxes, and distributing the remaining assets. This process can take months or even years, during which time your beneficiaries may not have access to your assets.

Increased Tax Burdens

A well-crafted estate plan can help minimize the tax burden on your estate. Without proper planning, your estate may incur higher taxes, diminishing the value of the assets passed on to your beneficiaries.

Loss of Control Over Healthcare Decisions

An estate plan often includes directives for your healthcare in the event you become incapacitated. Without these directives, decisions about your medical care will be made by family members or a court-appointed guardian. This may lead to choices that are not in line with your wishes.

If you haven’t already set up an estate plan, we encourage you to take action now. Don’t leave the future of your assets and the well-being of your loved ones to chance. Contact us for a consultation, and let our team guide you through the process of securing a comprehensive and effective estate plan.

How Often You Should Update Your Estate Plan

Estate planning is not a one-time event but an ongoing process. As life changes, so should your estate plan. We emphasize the importance of regularly reviewing and updating your estate plan to ensure it continues to reflect your current circumstances and wishes.

Life Events Triggering an Estate Plan Review

- Marriage or Divorce. Changes in marital status are significant triggers for updating an estate plan. New marriages may mean adding a spouse as a beneficiary, while divorce might necessitate removing a former spouse from your will or trust.

- Birth or Adoption of a Child. The arrival of a new family member means considering guardianship issues and adjusting how your assets will be distributed.

- Death of a Beneficiary or Executor. The death of someone named in your will can significantly impact how your estate will be managed and distributed.

- Changes in Relationships. Over time, your relationships with friends, family, and chosen executors or trustees might change, necessitating a review of your estate plan.

- Significant Financial Changes. If you experience a substantial increase or decrease in your assets, it’s vital to reassess how your estate is structured.

- Changes in Tax Laws. Tax laws are constantly evolving, and changes can impact your estate plan. Regular reviews ensure your plan is as tax-efficient as possible.

- Health Changes. A decline in your health or that of a beneficiary can necessitate changes in your estate plan, particularly concerning powers of attorney and healthcare directives.

The Recommended Frequency of Estate Plan Reviews

While there’s no one-size-fits-all answer, a general rule of thumb is to review your estate plan every three to five years. However, if any of the aforementioned life events occur, you should review your plan as soon as possible. Regular review verifies that your estate plan aligns with your current goals, family dynamics, and financial situation.

The Benefits Of Having Beneficiaries

Designating beneficiaries is a fundamental aspect of financial and estate planning. This process involves specifying individuals or entities who will receive your assets upon your death.

Streamlined Asset Distribution

When you name beneficiaries, you provide a clear roadmap for distributing your assets. This direct transfer to beneficiaries can often avoid the probate process, allowing for a more efficient and faster distribution of assets. Probate can be a lengthy and public process, so bypassing it not only saves time but also preserves privacy.

Minimized Family Disputes

One of the most significant benefits of naming beneficiaries is the reduction of potential conflicts among family members. Clearly designated beneficiaries eliminate ambiguity about who receives what, reducing the likelihood of disputes among heirs. This clarity can help maintain family harmony after your passing.

Control Over Your Legacy

By naming beneficiaries, you exercise control over your legacy. You decide who benefits from your life’s work, ensuring that your assets are distributed according to your wishes. This control is particularly important in complicated family situations, such as those involving stepchildren, previous marriages, or charitable intentions.

Potential Tax Benefits

In certain cases, naming beneficiaries can provide tax advantages. For example, when life insurance proceeds are paid directly to a named beneficiary, they generally are not subject to income tax. Retirement accounts and other financial instruments may also have tax benefits when beneficiaries are properly designated.

Protection of Beneficiaries’ Interests

Designating beneficiaries can also provide a level of protection for their interests. For example, in the case of minor children, you can establish trusts as part of your beneficiary designations, so that the assets are managed responsibly until the children are of age.

Flexibility and Ease of Changes

Another benefit of naming beneficiaries is the ease with which you can update your designations. Life changes such as marriage, divorce, births, and deaths necessitate updates to your beneficiary designations. Most financial accounts and policies allow you to change your beneficiaries without the need for a legal process, making it a flexible part of your estate plan.

We understand the importance of correctly designating beneficiaries in your estate plan. Our team provides comprehensive guidance on how to effectively integrate beneficiary designations into your overall estate strategy, making sure your wishes are fulfilled and your beneficiaries are protected.

5 Myths About Estate Planning

There are several myths and misconceptions surrounding estate planning that can lead to confusion or poor decision-making, which is why it’s important to have our experienced Baton Rouge estate planning lawyer who will help you avoid mistakes. Below, we have debunked five common myths about estate planning, providing you with accurate information to make informed decisions.

Estate Planning is Only for the Wealthy

One common myth is that estate planning is only necessary for individuals with substantial wealth. Estate planning allows you to specify your healthcare preferences, designate guardians for minor children, and distribute your assets according to your wishes. Regardless of the size of your estate, having a proper estate plan means that your loved ones are protected and your wishes are honored.

Estate Planning is Only About Creating a Will

While creating a will is an integral part of estate planning, it is not the only document involved. Estate planning encompasses various legal instruments, including trusts, powers of attorney, advance healthcare directives, and beneficiary designations. These estate planning tools enable you to address specific aspects of your estate, such as managing assets during incapacity, reducing estate taxes, and providing for long-term care. A comprehensive estate plan considers your unique circumstances and goals, providing a holistic approach to protect your interests.

Estate Planning is Only for Older Individuals

Another common myth is that estate planning is only necessary for older individuals or those in poor health. However, accidents and unexpected events can occur at any age, making it never too early to contact our estate planning attorney. Regardless of your age or health status, having an estate plan in place allows your loved ones to be provided for and your wishes are carried out if the unexpected happens. Estate planning is a proactive step that offers peace of mind and protects your interests at any stage of life.

Estate Planning is a One-Time Event

Some individuals mistakenly believe that estate planning is a one-time event and that once a plan is created, it does not require further attention. In reality, estate planning is an ongoing process that should be reviewed and updated periodically to reflect changes in your life circumstances. Life events such as marriage, divorce, birth of children, changes in financial status, or the acquisition of new assets may necessitate revisions to your estate plan. Regularly reviewing and updating your plan makes sure that it remains relevant and aligned with your current wishes and objectives.

Estate Planning is Only About Passing on Assets

Many people believe that estate planning is solely focused on passing on financial assets to beneficiaries. While asset distribution is a significant aspect of estate planning, it encompasses much more. Estate planning also includes planning for healthcare decisions, appointing guardians for minor children, establishing trusts for loved ones, and protecting your interests during incapacity. It allows you to outline your wishes regarding end-of-life care, designate someone to manage your affairs if you become incapacitated, and provide for the well-being of your loved ones beyond financial matters.

Baton Rouge Estate Planning Infographic

Baton Rouge Estate Planning Statistics

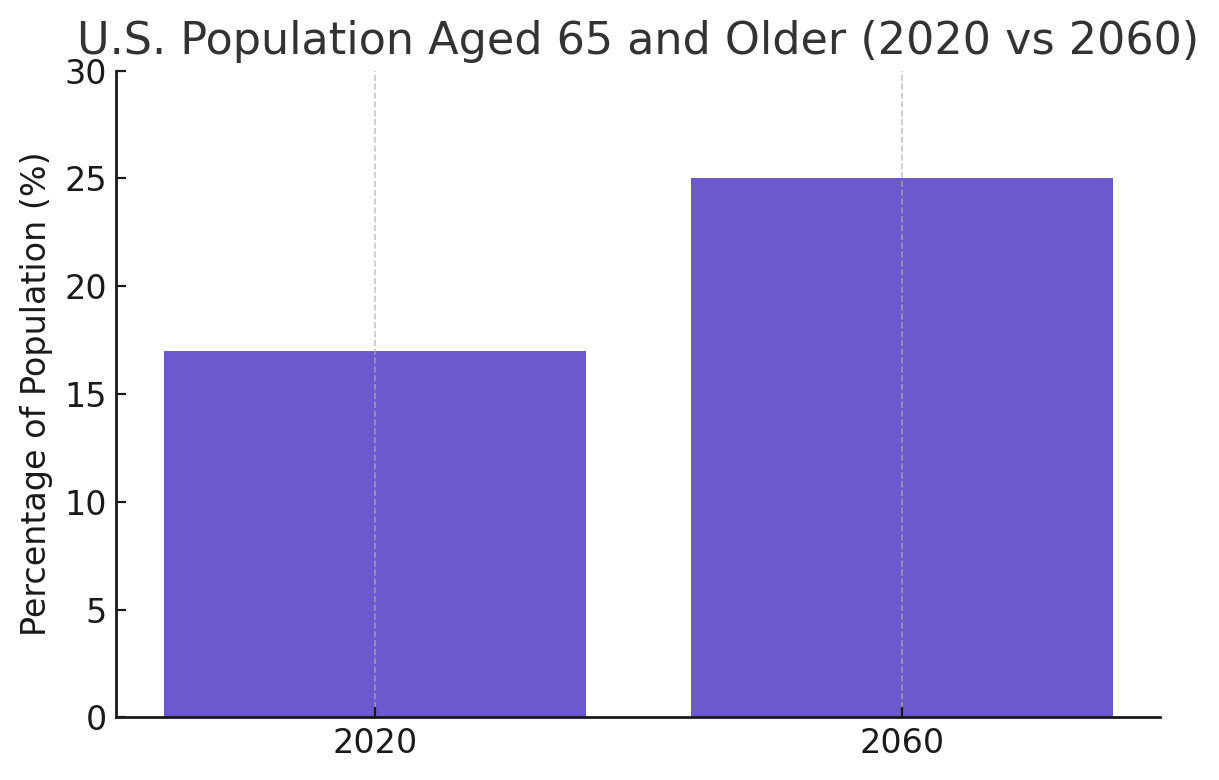

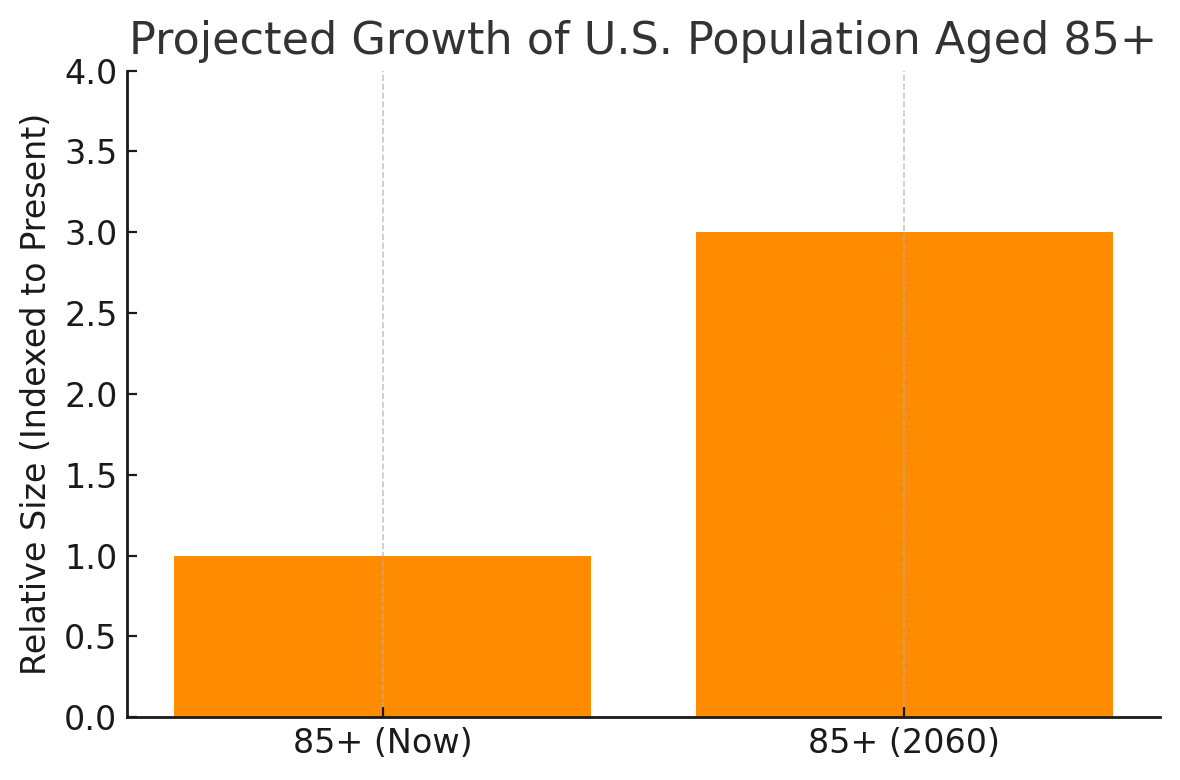

According to the U.S. Census Bureau, by the year 2060, a quarter of the U.S. population will be 65 years of age or older. The Census Bureau also predicts that the number of people in this country who are 85 years or older will triple the number right now.

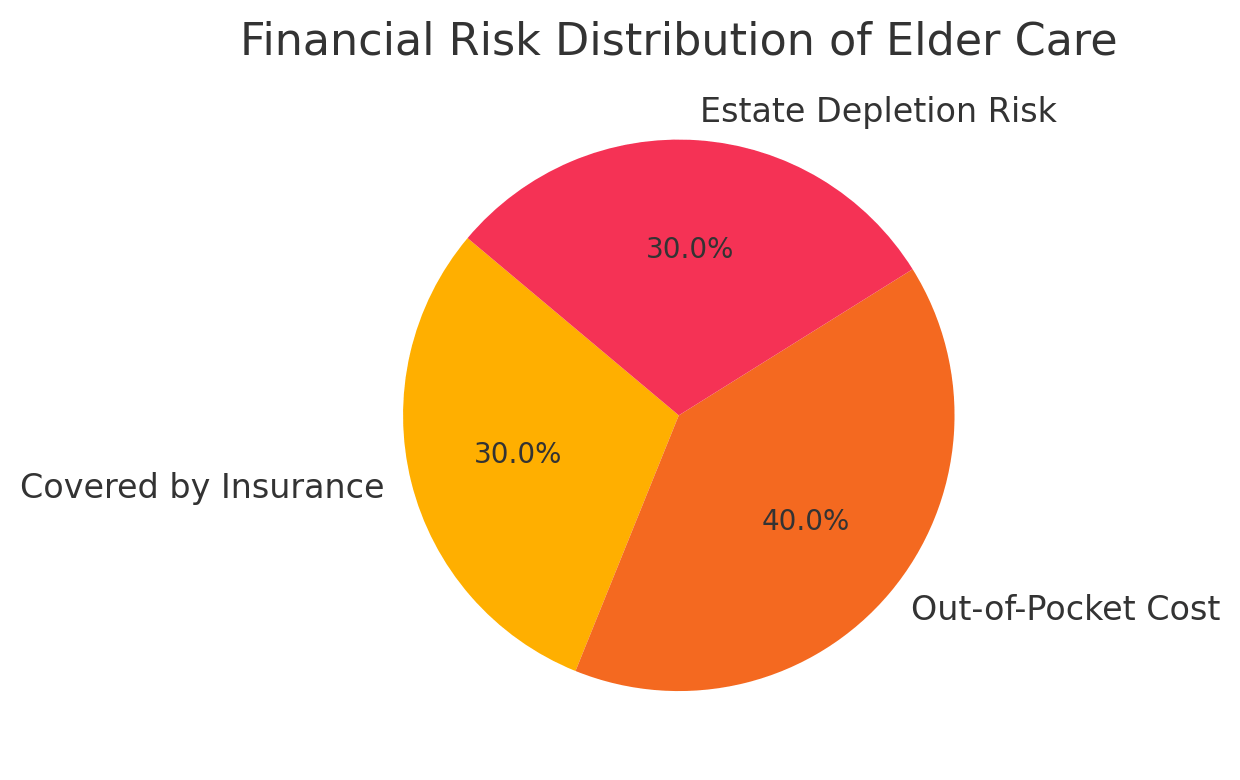

However, it is important to realize that with the increased number of older Americans, there will also be a significant need for facilities to help with elder care. These facilities can effectively wipe out a person’s life savings because of the exorbitant fees they charge. Don’t let this happen to you. Contact our estate planning team for legal help protecting your finances and assets.

Estate Planning FAQs

If you are thinking about securing your assets and creating a plan so your loved ones are taken care of after you pass away, then you’ll want to work with our attorney. Our professionals can help you understand the confusing legal system, confirm that your assets are distributed according to your wishes, and provide peace of mind for you and your family. Here are some frequently asked questions about estate planning lawyers in Baton Rouge:

What Is An Advance Directive?

An advance directive is a type of legal document that allows a person to explain their preferences regarding their healthcare and who can make decisions on their medical treatment if they become incapacitated. It encompasses instructions for end-of-life care, resuscitation, pain management, and organ donation. By creating an advance healthcare directive, individuals can make sure their healthcare wishes are respected and followed, providing peace of mind to both themselves and their loved ones during challenging and emotional times. It also relieves the burden on family members, who may otherwise have to make difficult decisions without clear guidance.

How Can I Reduce Estate Taxes?

Estate taxes can be a significant concern for individuals with substantial assets. To reduce estate taxes, it is essential to employ various estate planning strategies. One commonly used strategy is making lifetime gifts to reduce the overall value of your estate. By gifting assets to family members or loved ones during your lifetime, you can decrease the taxable value of your estate, potentially lowering the tax burden for your heirs. These trusts also allow certain tax advantages and let you retain control of your assets while you are alive. Furthermore, taking advantage of annual gift tax exclusions and maximizing the use of applicable tax deductions and exemptions can further minimize the impact of estate taxes.

What Can I Do To Avoid Probate?

Probate is a legal process that validates a deceased person’s will and facilitates the proper distribution of their assets. There are several ways to avoid it. One common method is establishing a revocable living trust, which allows you to transfer assets into the trust and designate beneficiaries. As the assets are held within the trust, they can be distributed according to your wishes without going through probate. Additionally, jointly owning assets, designating beneficiaries for retirement accounts and life insurance policies, and utilizing payable-on-death (POD) or transfer-on-death (TOD) designations can also bypass the probate process.

What Are the Risks Of Not Hiring An Estate Planning Lawyer?

Not hiring our estate planning lawyer poses several risks. Estate planning involves challenging legal matters, and without professional guidance, you may make critical errors that could have long-lasting consequences. DIY estate plans or using generic templates may not account for your specific circumstances and can leave gaps or ambiguities in your documents, leading to legal disputes or invalidation. If you need help from an experienced lawyer to give you specific legal advice, review your documents, explain your full legal rights, and make sure that you have everything necessary to complete your plan, contact our law firm for more information now.

Baton Rouge Estate Planning Glossary

Consulting with our experienced Baton Rouge, LA estate planning lawyer is essential for avoiding potential legal issues down the road. At Theus Law Offices, our award-winning team understands that estate planning is a necessary process for individuals who want their wishes carried out after their death. It involves creating legal documents and strategies to manage one’s assets, organizing long-term care for loved ones, and minimizing the burden on family members. Below are five important legal terms often encountered when working with our Baton Rouge estate planning attorney. We know that this estate planning glossary plays a significant role in the decision-making process, helping individuals protect their assets and loved ones.

Power Of Attorney

A power of attorney is a legal document that grants another person the authority to act on your behalf in various matters, such as financial or healthcare decisions. The person given this power is called the “agent” or “attorney-in-fact.” This document is essential in case you become incapacitated and unable to make decisions for yourself. It can be limited to specific tasks or be a broad, general power covering all matters.

Intestacy Laws

Intestacy laws come into play when a person dies without a valid will or estate plan. These laws are designed so that a deceased person’s estate is distributed according to state laws. Typically, intestacy laws prioritize close relatives like spouses and children, but the exact distribution depends on the state’s laws. Without a proper estate plan, intestacy can lead to unintended beneficiaries receiving portions of the estate, which may not align with the deceased person’s wishes.

Probate

Probate is the legal process through which a deceased person’s estate is administered. During probate, the court validates the will, if one exists, and pays all debts before assets are distributed to beneficiaries. Probate can be time-consuming and expensive, as it often involves court fees, legal costs, and the need for formal appraisals. Proper estate planning can help reduce the challenges of probate or avoid it altogether through mechanisms like trusts.

Guardianship Designations

A guardianship designation involves appointing a guardian to care for your minor children in the event that both parents are no longer able to fulfill that role. This designation makes sure that a trusted individual will be responsible for the child’s upbringing, education, and welfare. Without a guardianship designation, the court will decide who gets to raise your children, which may not be in line with your preferences.

Beneficiary Designations

Beneficiary designations are critical in estate planning because they dictate who will inherit certain assets, such as life insurance policies, retirement accounts, and bank accounts. Unlike the terms of a will, beneficiary designations override any other directives in a will, so it is essential to review and update these regularly. According to our skilled Baton Rouge estate planning lawyer, if beneficiaries are not properly designated or updated, it can cause confusion and disputes among heirs after your death.

Contact Our Estate Planning Lawyer today!

For those residing in Baton Rouge, the process of estate planning, though layered, doesn’t have to be daunting. Our seasoned legal team at Theus Law Offices is well-versed in the aspects of Baton Rouge estate planning. With our experienced assistance at your side, you can confidently craft an estate plan that not only echoes your wishes but is also robust enough to weather any legal challenges. Call to schedule a free 15-minute phone call. Reach out to our Baton Rouge estate planning lawyer team today, and let’s embark on this journey together. We will help you protect, celebrate, and plan your legacy.