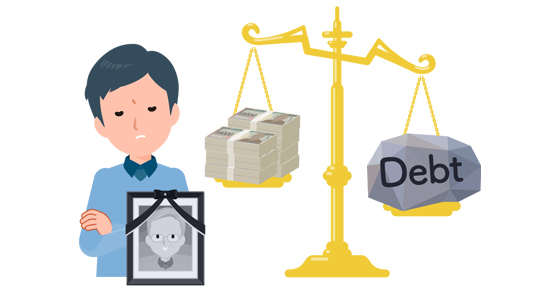

Should A Living Trust Be Part Of Your Estate Plan?

As its name suggests, a living trust (also known as a revocable trust) is in effect while you’re alive. It’s a legal entity into which you title assets to be managed during your lifetime and after your death. As the trust’s grantor, you typically serve as the trustee and retain control over the assets during […]

Should A Living Trust Be Part Of Your Estate Plan? Read More »